Emergency Rally to Say NO to all threats being made to takeaway our traditional Medicare with premium-free Senior Care

Join us at UFT Headquarters -52 Broadway - as we greet Pres. Michael Mulgrew, other UFT union leaders and the delegates as they enter the Delegate Assembly.Wednesday, Dec. 21st at 3:30pm

Speakers, Music and ChocolateKEEP OUR EXCELLENT HEALTHCARENO PRIVATIZED MEDICARE DIS-ADVANTAGE PLANNO ARBITRATOR DECISIONA contingent will march to DC37 & the Municipal Labor Committee (MLC) Headquarters at 55 Water St. to deliver this message

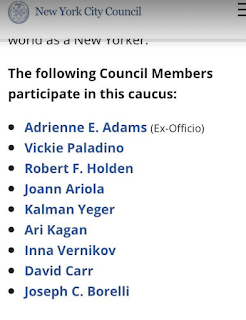

The Republicans and a couple of conservatives are saying health benefits are part of our constitutionally protected pension protections? Republicans hate public anything. Now, they don't want privatized Medicare. They are publicly opposing it. This is amazing.But his conclusion: that the City Council must gut Administrative Law 12-126 in order to preserve health insurance choices would be laughable if it weren’t so serious. It is akin to the Army’s rationale during the Vietnam War that, “We had to destroy this village in order to save it.”

A Proposal for Protecting the Health-Care Benefits

of New York City Workers, Retirees, and Their Dependents

While Saving the City Money and Curtailing Runaway Health-Care Costs

BACKGROUND

Under Administrative Code 12-126, municipal workers, retirees, and their dependents are guaranteed premium-free health coverage up to the HIP-HMO benchmark, approximately $775/mth. This law has been in force since 1967. Retirees and active workers alike depend on this health-care coverage.

Health-care costs are paid by the City from two funds:

-

The Retiree Health Benefits Trust (RHBT), used exclusively by the City to pay for retirees’ Medicare and Senior Care premiums. At the moment it is well funded, but health-care costs keep going up and the City’s obligation is becoming more expensive.

-

The Health Insurance Stabilization Fund (HISF), used by the various unions to pay for active workers’ excess health insurance premiums as well as other benefits – dental, visual, podiatry, drug plans, etc – for both active and retired workers. In the past it has been treated as a slush fund to cover non-health-related costs, most notably in 2014, when $1 billion was withdrawn from the fund to cover wage increases for active workers. Now the HISF is going broke. If this happens, there will be no money to pay for union members’ health benefits.

This is the problem in a nutshell: In the long run, the City needs to limit the cost of its health-care obligation. In the short run, the unions need to have the HISF replenished.

THE EASY BUT WRONG SOLUTION

Shift the City’s 250,000 retirees and their dependents out of traditional Medicare + Senior Care and into a Medicare Advantage plan. MA plans are entirely paid for by the federal government and are run by private health insurance companies. While MA plans supposedly provide the same coverage as traditional Medicare plus Medicare supplemental plans, the funds available to these plans are nearly 25% below what is currently available through Medicare + Senior Care. So MA plans rely heavily on limited provider networks and denial of care to keep their costs down and preserve their profits.

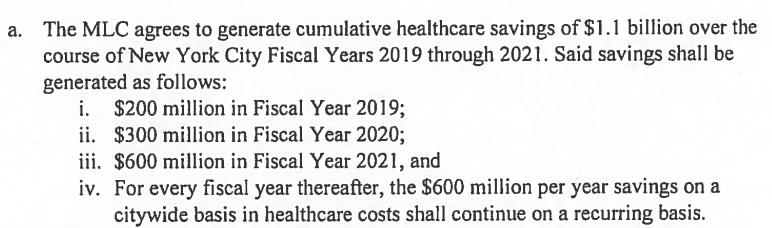

The switch to Medicare Advantage would result in savings of $600 million per year to the City. This constitutes a mere 0.6% of the total City budget – a drop in the bucket for the City – but it would provide a quick way to replenish the depleted HISF. This appeared to be an easy solution, especially since the retirees lack representation and negotiating power.

But the solution backfired. In 2021, when retirees discovered the forced switch to Medicare Advantage, they self-organized and fought back. Over 65,000 retirees opted out of the City’s MA plan even though opting out meant they would have to pay the Senior Care premium, roughly $200/mth. The NYC Organization of Public Service Retirees raised enough money from thousands of pensioners and took the City to court. In 2022, the NYS Supreme Court declared that, under Administrative Code 12-126, the City could not charge retirees for their Senior Care. The City appealed – and lost. With Senior Care remaining premium-free, the plan to switch retirees to Medicare Advantage collapsed.

Now the City has opened a new assault on its retirees:

-

It is attempting to get City Council to modify the language of Administrative Code 12-126 to allow for different “benchmarks” and “classes.” Such a change threatens not only retirees but also active workers. Instead of a guaranteed benefit, health-care coverage would be thrown open to negotiation. Different coverage, with much lower benchmarks, could be offered to different classes: teachers, clericals, uniformed actives, retirees, dependents, those with more or less seniority, etc.

-

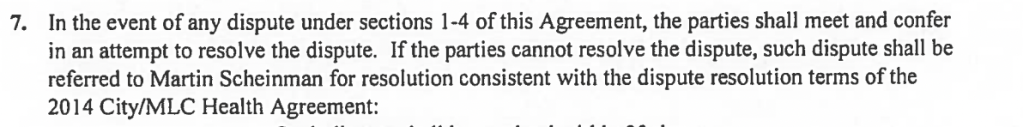

Mayor Adams and the mediator of City health benefits, Martin Scheinman, are threatening to impose a “nuclear option” – offering only one health-care option to retirees, namely, Medicare Advantage. Take it or leave it. All or nothing.

Bizarrely, the MLC and its two controlling unions, the UFT and DC37, are also urging all their members to contact City Council and demand that Administrative Code 12-126 be changed – even though such a change will jeopardize active workers’ health-care coverage. Why? Because the unions are desperate to replenish the HISF.

A BETTER SOLUTION

The switch to Medicare Advantage is a short-term solution. It does nothing to rein in health-care costs or the continued misuse of the HISF as a slush fund. It would substantially reduce the services available to retirees and cause significant hardship for any retiree who becomes sick and needs care.

A long-term solution is needed, one that holds down costs but does not jeopardize the health coverage of either retirees or active workers. The PSC has put forward a proposal that CROC supports: for the City to withhold $0.5 billion from the Retiree Health Benefits Trust for the next two years and instead use that money to shore up the Health Insurance Stabilization Fund. This would allow time to seriously evaluate effective cost-cutting solutions that the City and the MLC have themselves put on the table but have not actively investigated or pursued:

-

Set up a municipal self-insurance plan for all actives, retirees, and their dependents. This would greatly reduce the high overhead costs charged by private insurance companies and give the City greater leverage with hospitals and other costly providers.

-

Require lower costs from the private hospitals, which are currently charging exorbitant fees.

-

Address the skyrocketing costs of prescription drugs by consolidating union welfare fund drug plans and

negotiating lower rates for all.

-

Audit current insurance providers for potential fraud and duplication.

-

Reduce money wasted from bad insurance management and inefficiencies.

Adopting a more rigorous approach to cost-cutting using these measures will result in long-term health-care savings and obviate the need to cut benefits to either active or retired workers.